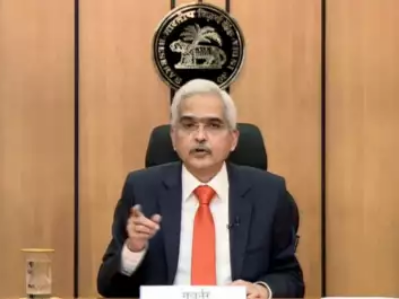

Major Concerns Are Voiced By The RBI Governer About Cryptocurrencies

The Reserve Bank of India (RBI), is very much concerned about the impact of cryptocurrencies that can affect the financial stability of the economy. The RBI has conveyed the same to the government and it has been said by Shaktikanta Das on Wednesday.

While speaking on an interview, he has said that there are certainly major concerns of RBI related to cryptocurrencies. They have communicated this to the government and it has been considered by the same. They are also expecting that sooner or later a call will be taken by the government and if it is needed it will be called and decided by the Parliament.

Das also went on to say that he wants to state it clearly that blockchain technology is quite different. The benefits of Blockchain technology have to be exploited and it is a separate thing altogether. But there are major concerns about the financial stability concerning crypto and it has been shared with the government. A call is expected to be taken by the government on the issue of cryptocurrency.

Das did not add much more to it but in the past, the Central Bank has expressed concerns regarding digital currencies that are being used for terror funding and money laundering.

A new bill is planned to be introduced by the government in the Parliament to bar individuals and companies from dealing with cryptocurrencies as they have created a framework for a digital currency that is official.

Banks have been banned by the RBI in 2018 and they have also regulated entities from transactions regarding crypto after the digital currencies have been used for frauds. The curbs are cut in the last year by the Supreme Court in response to the petitions by exchanges made through cryptocurrency.

Das also went on to say that the RBI is pretty much in the game and they are getting ready to launch their very own digital currency.

The work is in progress for a Central bank digital currency and the team at RBI is working on it regarding the procedural side as well as the technology side and they are finding out ways how it is going to be rolled out and launched.

If things fall in place, RBI is going to join the ranks of other Central Banks that includes the Chinese Central Bank where they have electronic yuan.

No date has yet been set about the date of the rollout but the project has been receiving full attention. Das also said that the Central Bank has been tying up the various loose ends.

Regarding inflation targeting, the governor of RBI has said that the report will be provided by an internal working group about the target band in the upcoming few days.

The RBI is mandated by the Monetary Policy Framework to maintain the retail inflation and consumer price index at 4% in a band of (+/-) 2 percent to be reviewed in March end.

Glenda Bozeman – Business and Services

Glenda Bozeman writes Business articles for industries that want to see their Google search rankings surge. Her articles have appeared in a number of sites. Her articles focus on enlightening with informative Services sector needs. She holds the degree of Masters in Business and Marketing. Before she started writing, she experimented with various professions: computer programming, assistant marker, and others. But her favorite job is writing that she is now doing full-time.